Turn Your Side Hustle into a Full-Time Business with a SBLC Financing

May 6, 2025

The Impact of Economic Changes on Small Business Lending in 2025 – Part 1

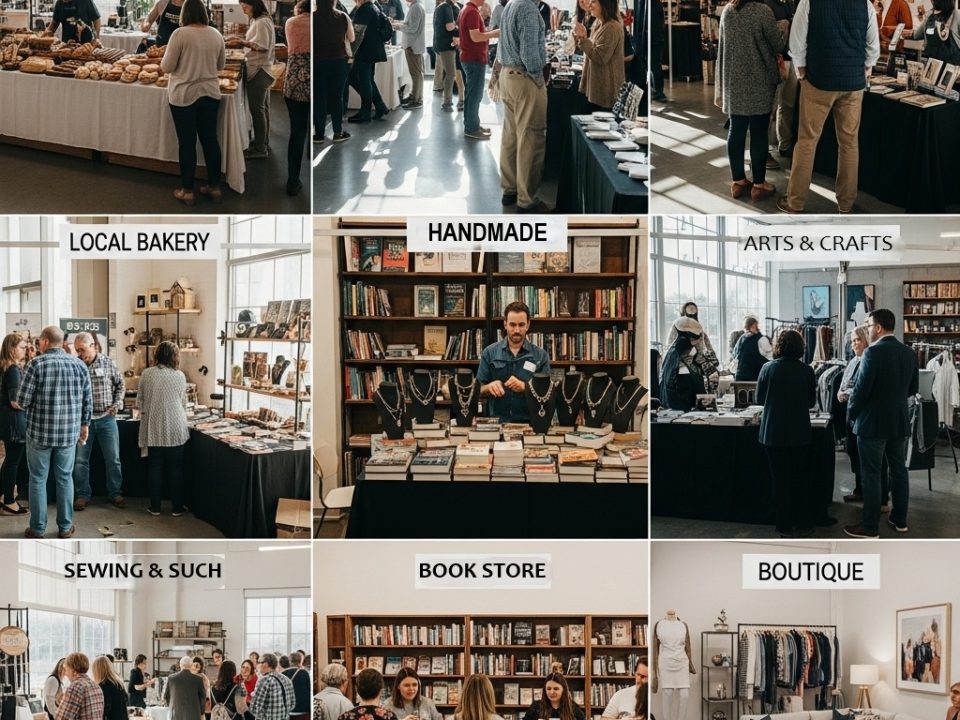

June 3, 2025In today’s ever-changing economy, a rising number of people are starting their own side hustles—small ventures run after hours, on weekends, or during spare moments. While a side hustle can be a great way to supplement your income or explore a passion project, many entrepreneurs eventually reach a crossroads: Should you keep it on the side, or make the leap to a full-time business? Although transitioning to full-time self-employment is a significant decision, it comes with a host of exciting benefits.

- Unlimited Income Potential

As a side hustler, your income is often capped by the hours you can spare outside your primary job. Moving to a full-time business means you can dedicate all your time, skills, and energy to something you’re more passionate about, and grow your own business. This opens the door to increased sales, new customers, and multiple revenue streams—potentially taking your income far beyond what your side hustle alone could provide.

- Total Control Over Your Time and Career

Being your own boss comes with unmatched flexibility. You set your own schedule and create a work-life balance that fits your needs and values. This autonomy allows you to pursue projects you’re passionate about and make the decisions that shape your company’s future, free from the constraints and politics of a traditional job.

- Personal and Professional Growth

Turning your side hustle into a full-time enterprise is an opportunity for transformation. You’ll gain new skills in leadership, sales, marketing, finance, and more. Every challenge you learn to overcome adds to your toolkit, making you a more resilient and savvy entrepreneur. The experience you gain can be more valuable—and more rewarding—than any corporate training program.

- A Greater Sense of Fulfillment

Many side hustlers start their ventures because they’re passionate about their work. Taking your business full-time means you get to spend each day doing what you love, helping clients, or making products that truly matter to you. This sense of purpose and fulfillment is difficult to match in most traditional employment scenarios.

- Building an Asset for the Future

A successful full-time business isn’t just a job—it’s an asset. Over time, your business can build value, offer tax advantages, create job opportunities for others, and can even become something you can sell or pass along to your family. Full-time business owners are in a powerful position to create legacy and wealth that go far beyond a regular paycheck.

- Stronger Impact and Community Influence

With more time and resources dedicated to your venture, you’re able to scale your impact—whether that’s serving more customers, supporting causes you care about, or creating employment in your community. Business ownership amplifies your ability to bring about change and make a difference.

Conclusion

Transforming your side hustle to a full-time business isn’t always easy or risk-free. But the benefits—financial freedom, autonomy, growth, fulfillment, and long-term value—can make the leap worthwhile. If your side hustle is thriving and you’re prepared for the challenges, taking your business full-time could be the most empowering career move you ever make; and while this move will most certainly require an investment – not only of time, but resources and cash – you can be well on your way with a Working Capital Loan for the cash investment requirement.

Ready to Make the Leap?

Qualify for a Side Hustle to Full-Time Business Transition Loan

Are you dreaming of turning your profitable side hustle into your primary source of income? The jump from side gig to full-time entrepreneurship is exciting, but it takes planning—and funding. The Side Hustle to Full-Time Business (SH2FB) Transition Loan could be your bridge to business ownership. Here’s how to ensure you qualify:

First – Open a Dedicated Account for Your Side Hustle

If you haven’t already, set up a separate bank account exclusively for your side hustle earnings. A dedicated account demonstrates professionalism and makes it easier to track your income and manage your finances.

Second – Show Consistent Side Hustle Activity (6+ Months)

Lenders want to see that your business idea is viable. Make sure you can document at least six months of consistent activity. Stability matters!

Third – Make Frequent Bank Deposits

To demonstrate active business, make at least five deposits or more per month into your side hustle’s bank account from earned revenue. This consistent activity proves you’re not just dabbling.

Fourth – Meet the Minimum Revenue Threshold

Your side hustle should be generating a minimum of $5,000 per month in revenue. This level signals readiness to transition to the full-time business world.

Fifth – Obtain a Tax ID Number (EIN)

If you haven’t already, take the official step of securing an Employer Identification Number (EIN) for your business. This is a key move for legitimacy, and it’s usually free and fast via the IRS website.

If you already have these things in place, you’re prepared to shift your side hustle into a thriving full-time business! Click here to apply for your SH2FB transition loan.