Small Business Lending: A historical perspective

May 2, 2025

Benefits of Transforming Your Side Hustle to a Fulltime Business

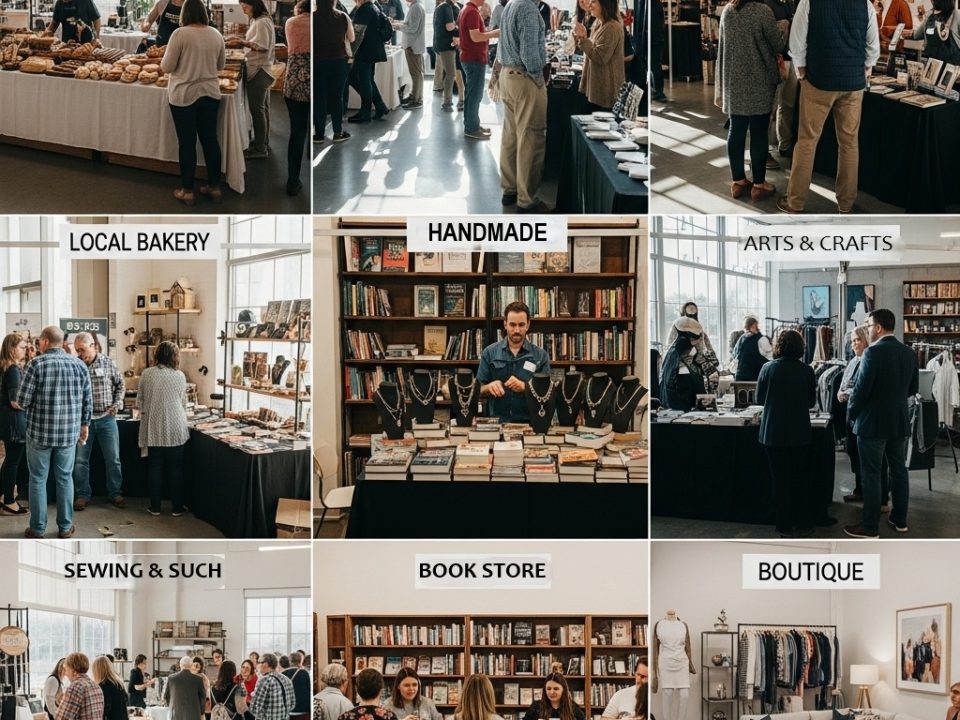

May 16, 2025For years, side hustles have helped millions of people turn passions into profit. Maybe you sell handmade crafts online, offer freelance consulting, or run a thriving food delivery gig. As your side hustle grows, the ultimate dream may emerge: making it your full-time job. But moving from “side” to “center stage” can feel daunting—especially when your business needs more cash to scale.

Enter the small business loan. Used wisely, it can be the bridge that turns your hobby into a flourishing, full-time enterprise. Here’s how a small business loan can help—and how to set yourself up for long-term success.

Why Consider a Small Business Loan?

Side hustles often start scrappy: working from home, reinvesting profits, and juggling responsibilities. These early stages prove your concept and build an initial customer base. But growth usually demands resources: inventory, equipment, marketing, or even hiring your first employee.

A small business loan offers:

- Injection of Capital: Quickly access funds to cover startup or expansion needs.

- Business Credit Building: Timely payments establish your business’s credit profile.

- Growth Momentum: Borrowing helps you catch big opportunities—before competitors do.

Steps to Prepare for a Small Business Loan<

- Evaluate Your Side Hustle’s Potential

Ask yourself: Is there real, sustained demand? Are revenues and profits growing? Do you have repeat customers, or is word-of-mouth bringing in new leads? - Write a Simple Business Plan

A clear plan shows lenders you’re serious and organized. At a minimum, include:- Description of your products/services

– Target market

– Marketing strategy

– Financial projections and funding needs - Check Your Personal and Business Credit

Even if you haven’t formally registered your business yet, your personal credit will matter. Review your credit reports and correct any errors. - Register and Structure Your Business

Forming an LLC or corporation helps separate your personal and business finances—a must for credibility (and some loan types).

Choosing the Right Loan

Not all loans are created equal. Consider these common options:

- SBA Microloans: Backed by the Small Business Administration, these loans are perfect for new businesses seeking up to $50,000.

- Online Lenders: Platforms like Kabbage, OnDeck, or LendingClub offer speed and accessibility, sometimes with less stringent requirements.

- Traditional Bank Loans: Offer low rates and longer terms, but require a strong credit profile and established business history.

- Business Credit Cards: Useful for cash flow, but interest rates can be high—use with caution.

Compare rates, repayment terms, and eligibility criteria before applying.

Making the Leap: Smart Use of Loan Funds

A loan brings responsibility. Maximize its impact by:

- Investing in high-impact priorities: Inventory, equipment, website updates, marketing.

- Hiring key help: Move past “doing it all yourself” by onboarding part-time support or contractors.

- Expanding reach: Use funds to try social media ads, open a pop-up shop, or attend industry events.

- Monitor your return on investment so every dollar works toward sustainable growth.

Keys to Success: Financial Discipline & Mindset Shift

Most importantly, treat your side hustle “like a real business” from day one. Track expenses, set aside money for taxes, and measure your progress. Gradually transition responsibilities, and don’t be afraid to outsource tasks you don’t excel at.

A well-managed loan unlocks freedom and opportunity. With strategic planning and disciplined execution, your side hustle can become your main gig—and even far surpass it.

Conclusion:

Your side hustle has potential. Accessing a small business loan could be the key to scaling up, seizing new markets, and finally making your passion your profession. Prepare thoroughly, borrow wisely, and take the leap with confidence—you might just surprise yourself with how far you can go.

Qualify for a SH2FB Loan

Your Step-by-Step Guide to Business Funding

Thinking about moving from a steady side hustle to a thriving full-time business? The SH2FB Transition Loan is designed to fund your leap. Here’s how to get ready:

- Set Up a Separate Bank Account

If you haven’t done so, open a new account for your side hustle revenue. Lenders view this as a sign of business seriousness and fiscal discipline.

- Stay Active for At Least 6 Months

Your hustle should be running for at least half a year, demonstrating reliability. Keep thorough records—these will be vital during the application process.

- Make Regular, Frequent Deposits

Shoot for a minimum of five deposits each month into your side hustle’s account. This level of consistent activity is one of the clearest indicators of a thriving business.

- Hit the $5,000/Month Revenue Mark

Show at least $5,000 a month in regular revenue—this proves you are stable and ready to scale.

- Secure a Business Tax ID

A tax ID (EIN) is essential for legitimacy—and most lenders won’t proceed without it. Don’t wait—apply for your EIN today if you haven’t already.

If you meet these criteria, you’re in a strong position to fund your business journey and move your side hustle to the spotlight. Apply for your SH2FB transition loan now.